Make Money While You Sleep: Top Passive Income Ideas for 2025

What if you could make money while you sleep? It may sound like a dream, but with the right passive income ideas, that dream can become a reality. Whether you’re aiming to supplement your income, achieve financial independence, or retire early, exploring smart passive income strategies is essential. In this article, we’ll walk you through the most practical and realistic passive income ideas you can start in 2025—perfect for beginners and pros alike.

Why Passive Income Matters:

Passive income provides financial security, reduces stress, and creates more freedom in life by generating earnings even when you’re not actively working. This steady flow of income can help you focus on what truly matters while your money works for you.

What to Expect:

In this article, you’ll discover 10 practical and proven passive income ideas that are realistic and actionable. These strategies are suitable for both beginners just starting out and advanced earners looking to diversify their income streams.

What is Passive Income and Why Should You Care?

What is Passive Income?

Passive income refers to earnings generated from sources that require minimal to no ongoing effort after an initial investment of time, money, or resources. Unlike active income, which requires continuous work—such as a 9-to-5 job, freelancing, or hourly wages—passive income streams allow individuals to earn money even while sleeping.

Key Differences Between Passive and Active Income

| Feature | Passive Income (e.g., dividends, digital products) | Active Income (e.g., salary, freelancing) |

|---|---|---|

| Effort Required | Initial effort; minimal maintenance | Ongoing work required |

| Time Commitment | Low after setup | High; dependent on time spent |

| Scalability | Can be scaled with automation | Limited by personal capacity |

| Example Sources | Rental income, stocks, eBooks, affiliate marketing | Salary, consulting, service-based work |

Passive income provides an opportunity for financial growth without being tied to a job, making it a key element in achieving financial independence. However, it still requires some level of effort and strategy in the beginning.

Benefits of Passive Income

Developing passive income streams offers several advantages that go beyond just earning extra money. Here’s why passive income is valuable:

Financial Freedom and Flexibility

- Passive income allows you to reduce dependence on a paycheck and build long-term wealth.

- You gain time freedom, meaning you’re not tied to a fixed schedule or location.

- This flexibility enables people to pursue hobbies, travel, or even retire early.

✅ Example: A successful blog that generates ad revenue allows you to work on your own terms.

Diversification of Income Streams

- Relying on only one source of income (e.g., a job) is risky.

- Passive income helps you spread financial risk across multiple sources.

- Even if one income source declines, other streams can keep cash flow steady.

✅ Example: A person earning from stock dividends, rental properties, and an online store is financially more secure than someone with just a salary.

Protection Against Job Loss or Economic Downturns

- Passive income acts as a financial safety net during economic recessions, layoffs, or unexpected expenses.

- It reduces financial stress by ensuring continuous earnings even during uncertain times.

✅ Example: During the COVID-19 pandemic, many people lost jobs, but those with rental properties, investments, or digital businesses had additional income sources to rely on.

Myth Busting: Common Misconceptions About Passive Income

Many people misunderstand passive income, assuming it’s an easy way to get rich or reserved for the wealthy. Let’s debunk the most common myths:

Myth 1 : “Passive Income Requires No Effort”

❌ False! While passive income reduces long-term effort, most streams require upfront work, investment, or learning.

✅ Reality: You need to set up systems before it becomes passive.

📌 Example: Writing an eBook or creating an online course takes time initially, but once completed, it can generate continuous sales with minimal maintenance.

Myth 2 : “You Need a Lot of Money to Start”

❌ False! Many passive income ideas don’t require huge capital—just creativity, consistency, and strategy.

✅ Reality: Several passive income sources can be started for free or with low investment.

📌 Example: Affiliate marketing, blogging, or YouTube content creation require little to no upfront investment.

Myth 3 : “Passive Income is Always Stable and Guaranteed”

❌ False! Passive income sources can fluctuate depending on market conditions, competition, and effort in maintenance.

✅ Reality: Smart diversification and reinvesting earnings help maintain stability.

📌 Example: Stock dividends may decrease during economic downturns, but if you have multiple passive income streams, you can balance your earnings.

Myth: “Passive Income is Only for Entrepreneurs or Business Owners”

❌ False! Anyone can earn passive income, regardless of their job or background.

✅ Reality: There are multiple ways to generate passive income, even with a full-time job.

📌 Example: A 9-to-5 employee can invest in dividend stocks, REITs (Real Estate Investment Trusts), or AI-powered businesses without quitting their job.

Key Takeaways:

- Passive income requires upfront effort but leads to long-term earnings.

- It diversifies your income, making you financially resilient.

- There are many ways to start passive income, even with little money.

🔥 Next Step: Identify which passive income stream works best for you and start building your financial future today! 🚀

10 Smart Passive Income Ideas to Build Wealth in 2025

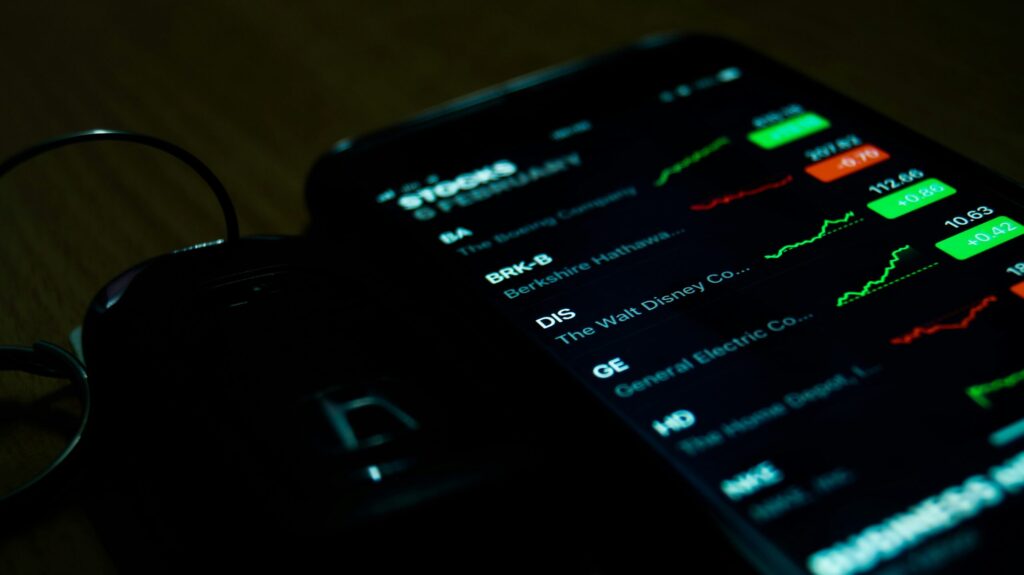

1. Divident Stocks

What It Is: Explain how dividend stocks work—companies pay shareholders a portion of their profits regularly.

How to Start:

- Open a brokerage account (e.g., Robinhood or E*TRADE).

- Research and invest in reliable dividend-paying stocks or ETFs (e.g., Coca-Cola, Johnson & Johnson, or Vanguard Dividend Appreciation ETF).

Pros: Steady income, potential for capital appreciation.

Cons: Requires initial capital, market risks.

Estimated Earnings: 500–500–2,000/year with a $10,000 investment.

Actionable Tip: I will share a list of the top 5 dividend-paying stocks ideal for beginners.

| Company | Logo | Ticker | Dividend Yield (Approx.) | Sector |

|---|---|---|---|---|

| Coca-Cola | KO | ~3.1% | Beverages | |

| Johnson & Johnson | JNJ | ~2.9% | Healthcare | |

| Procter & Gamble | PG | ~2.4% | Consumer Goods | |

| AbbVie Inc. | ABBV | ~3.9% | Pharmaceuticals | |

| Chevron Corp. | CVX | ~4.0% | Energy |

Notes:

- Dividend yields fluctuate based on market conditions. Always check the latest figures before investing.

- These stocks are part of Dividend Aristocrats, meaning they have a strong history of consistent dividend payments.

2. Create and Sell Online Courses: A Top Passive Income Idea

What It Is: Explain how creating and selling online courses on platforms like Udemy, Teachable, or Skillshare can generate passive income.

How to Start:

Choose a niche you’re knowledgeable about (e.g., digital marketing, photography, or fitness).

- Use tools like Canva or Camtasia to create engaging content.

- Promote your course through social media or email marketing.

Pros: High earning potential, scalable.

Cons: Requires upfront effort to create content.

Estimated Earnings: 500–500–5,000/month depending on course popularity.

3. Write an eBook: One of the Easiest Passive Income Ideas

What It Is: Explain how writing and self-publishing an eBook on Amazon Kindle Direct Publishing (KDP) can generate royalties.

How to Start:

- Choose a topic with high demand (use tools like Google Trends or Amazon Best Sellers).

- Write and format your eBook using tools like Scrivener or Vellum.

- Promote your eBook through social media or email lists.

Pros: Low startup cost, high royalties (up to 70% on Amazon).

Cons: Requires writing and marketing skills.

Estimated Earnings: 100–100–1,000/month depending on sales.

Actionable Tip: I will provide a list of tools for writing and formatting eBooks.

Scrivener

A powerful writing tool designed for authors, offering organization, research management, and formatting options. It’s ideal for long-form writing projects like novels, scripts, and academic papers.🔗 Scrivener Official Website

Adobe InDesign

A professional desktop publishing software perfect for designing and formatting visually appealing eBooks, print books, and other publications. It’s widely used by designers and publishers.🔗 Adobe InDesign Official Website

Calibre

A free and open-source eBook management tool that allows easy formatting, conversion, and organization of eBooks. It supports a wide range of formats and is great for eBook enthusiasts.🔗 Calibre Official Website

4. Invest in Real Estate Crowdfunding

What It Is: Explain how platforms like Fundrise or RealtyMogul allow you to invest in real estate with minimal capital.

How to Start:

- Sign up on a crowdfunding platform.

- Choose a project (e.g., residential, commercial, or REITs).

- Earn returns through rental income or property appreciation.

Pros: Low barrier to entry, diversified investments.

Cons: Illiquid investment, platform fees.

Estimated Earnings: 8–12% annual returns.

Actionable Tip: Compare popular real estate crowdfunding platforms.

| Platform | Minimum Investment | Fees | Investor Type | Key Features |

|---|---|---|---|---|

| Fundrise | $10 | 0.15% advisory + 0.85% asset management | Open to all investors | Low entry barrier, diversified real estate funds |

| RealtyMogul | $5,000 | Varies by offering | Open to non-accredited investors for REITs | Offers both equity and debt investments |

| CrowdStreet | $25,000 | Varies by project | Accredited investors only | Focuses on commercial real estate investments |

📌 Note: Fees and minimum investments may change over time. Always review platform details before investing.

5. Blog or YouTube Channel: Creative Passive Income Ideas That Scale

What It Is: Explain how monetizing a blog (through ads, affiliate marketing, or sponsorships) or a YouTube channel (through ad revenue) can generate passive income over time.

How to Start:

- Choose a niche (e.g., travel, tech, or personal finance).

- Create high-quality content consistently.

- Monetize through Google AdSense, affiliate links, or brand deals.

Pros: Creative freedom, scalable income.

Cons: Takes time to build an audience.

Estimated Earnings: 100–100–10,000/month depending on traffic.

Actionable Tip: Share tools like WordPress Free Theme for blogging or Canva for creating YouTube thumbnails.

For Blogging:

Ghost – A minimalist blogging platform focused on speed and SEO.🔗 Ghost Official Website

Medium – A publishing platform with a built-in audience for writers.🔗 Medium Official Website

Blogger – A free blogging service by Google, ideal for beginners.🔗 Blogger Official Website

For Creating YouTube Thumbnails:

Adobe Spark – A user-friendly tool for designing thumbnails and graphics.🔗 Adobe Spark Official Website

Snappa – A fast online tool with pre-made templates for YouTube thumbnails.🔗 Snappa Official Website

Fotor – A simple yet powerful design tool with an easy drag-and-drop interface.🔗 Fotor Official Website

6. Affiliate Marketing

What It Is: Explain how promoting products or services and earning a commission for every sale can be a lucrative passive income stream.

How to Start:

- Join affiliate programs like Amazon Associates, ShareASale, or ClickBank.

- Create content (e.g., blog posts, videos, or social media posts) to promote products.

- Earn commissions for every sale made through your referral link.

Pros: Low startup cost, scalable.

Cons: Requires traffic or an audience.

Estimated Earnings: 200–200–5,000/month depending on traffic and niche.

Actionable Tip: I will share beginner-friendly affiliate programs.

Amazon Associates

One of the most popular affiliate programs where you can promote millions of products and earn a commission on every sale. Easy approval, perfect for beginners.🔗 Amazon Associates Official Website

ShareASale

A large affiliate network offering thousands of products and services to promote across different niches. Features a user-friendly dashboard with various commission structures.

🔗 ShareASale Official Website

CJ Affiliate (Commission Junction)

A trusted platform that connects affiliates with well-known brands. Offers reliable payouts and multiple high-paying offers.🔗 CJ Affiliate Official Website

7. Rent Out Assets

What It Is: Discuss renting out assets like a spare room (Airbnb), a car (Turo), or even equipment (Fat Llama).

How to Start:

- List your asset on a rental platform.

- Set competitive pricing and ensure your asset is in good condition.

- Earn income from rentals.

Pros: High earning potential, flexible.

Cons: Requires maintenance and management.

Estimated Earnings: 500–500–3,000/month depending on the asset.

8. Create a Print-on-Demand Business

What It Is: Explain how platforms like Printful or Teespring allow you to sell custom-designed products without holding inventory.

How to Start:

- Choose a niche (e.g., funny quotes, pet lovers, or fitness enthusiasts).

- Create designs using tools like Canva or Adobe Spark.

- List your products on platforms like Etsy or Shopify.

Pros: No inventory risk, scalable.

Cons: Requires design skills and marketing effort.

Estimated Earnings: 100–100–2,000/month depending on sales.

Actionable Tip: I will share hare design Printful or Teespring.

9. Build a Membership Site

What It Is: Describe how creating a membership site (e.g., for exclusive content, courses, or communities) can generate recurring revenue.

How to Start:

- Choose a niche (e.g., fitness, business, or hobbies).

- Use platforms like Patreon or MemberPress to set up your site.

- Offer exclusive content or perks to members.

Pros: Recurring income, loyal community.

Cons: Requires consistent content creation.

Estimated Earnings: 200–200–5,000/month depending on membership fees.

Actionable Tip: Share platforms and tools for building a membership site.

10. Invest in Index Funds or ETFs

What It Is: Explain how investing in index funds or ETFs can provide long-term passive income through capital appreciation and dividends.

How to Start:

- Open a brokerage account (e.g., Vanguard or Fidelity).

- Research and invest in low-cost index funds or ETFs (e.g., S&P 500 Index Fund).

- Reinvest dividends for compound growth.

Pros: Low risk, diversified investments.

Cons: Requires initial capital, long-term commitment.

Estimated Earnings: 7–10% annual returns.

Actionable Tip: I will share beginner-friendly platforms and index funds.

Explore multiple passive income ideas to see which one aligns with your goals and lifestyle

3: Tips for Success with Passive Income

Start Small: Begin with one or two income streams and scale up.

Diversify: Don’t rely on a single source of passive income.

Be Patient: Passive income takes time to build but pays off in the long run.

Reinvest Earnings: Use your passive income to fund new ventures.

Actionable Tip: I will share passive income ideas.

Conclusion: Take Action on the Best Passive Income Ideas Today

Building wealth through passive income ideas isn’t a get-rich-quick scheme. But with consistency, patience, and the right tools, these strategies can create a steady income stream that grows over time. Start with one or two passive income ideas, scale as you learn, and let your money work for you. Which one will you try first?